BTC has recorded an ATH with its latest price trend.

Another ATH could be on the horizon with the ongoing rise in the coin’s realized cap.

The Bitcoin[BTC] market is no stranger to price volatility, with investors constantly observing metrics that signal potential shifts. Data on the coin’s realized cap is adding weight to a bullish narrative.

Recently, Bitcoin’s realized cap saw a significant uptick, a shift that could be crucial in forecasting BTC’s price direction.

What does the rise in realized cap imply for BTC’s price trend?

Bitcoin sees record realized market capitalization

The realized cap is an alternative to the market cap that accounts for each Bitcoin’s acquisition cost rather than its current market value. It reflects the sentiment of holders who acquired BTC at different price points.

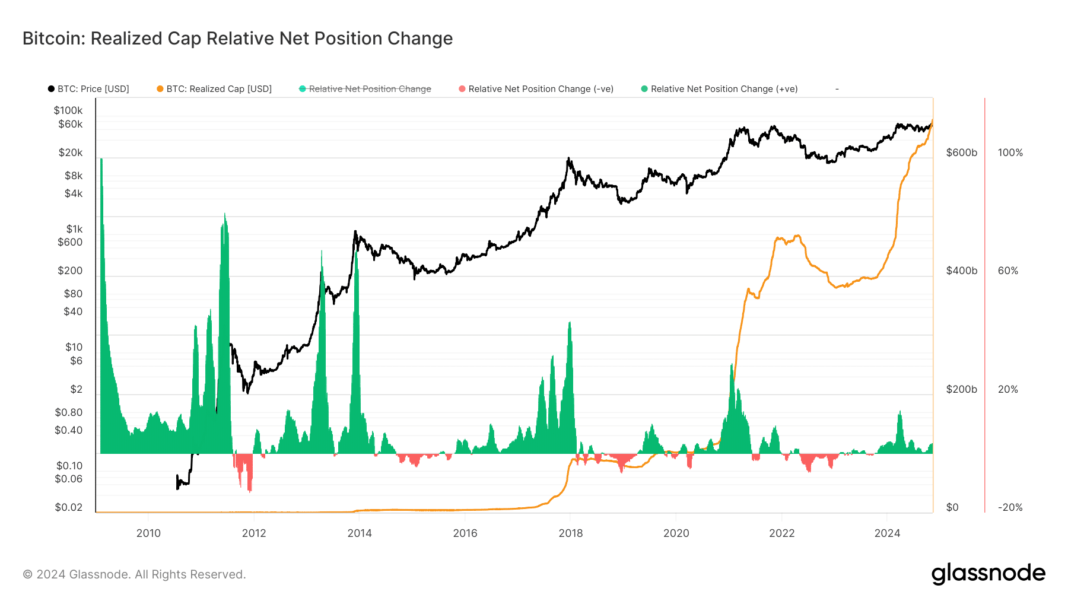

Analysis of the metric on Glassnode showed that it has risen to around $663 billion, the highest in its history.

Source: Glassnode

A rising realized cap suggests that coins held by long-term investors are growing in value. This is a positive sign of market stability and investor confidence. The recent increase in Bitcoin’s realized cap indicated that more capital is flowing into BTC, even as the price fluctuates.

For Bitcoin, an increased realized cap often indicates less selling pressure among holders. Analysis of the realized cap showed that over the years, when the metric hits an all-time high, there is usually a price decline, followed by another all-time high for the coin.

With BTC’s realized cap reaching new highs, it shows that investors have added confidence in the cryptocurrency’s future price growth. This potentially reduces the supply available for trading.

The impact on BTC’s price trend

The upward shift in realized cap could significantly impact Bitcoin’s price. As the realized cap grew, it suggested that more investors were holding onto their assets rather than selling.

This move could support BTC’s current price levels and provide a foundation for further price appreciation.

Source: TradingView

Technical indicators, such as the moving averages on BTC’s price chart, corroborate this sentiment. At press time, BTC was trending above its 50-day and 200-day Moving Averages(MA), showing bullish momentum.

If the realized cap continues to grow, it may encourage more investors to buy and hold, contributing to sustained price support at higher levels.

Key levels indicate BTC’s next move

Analysis of data from Hyblock pointed out that Bitcoin was trading within a tight range between the previous day’s high (pdHigh) and the combined levels of the previous day’s open and equilibrium (pdOpen + pdEQ). Market dynamics suggested significant resistance and support zones at these levels.

According to the latest data, BTC faced resistance around the pdHigh, where a cluster of short liquidation levels indicates strong selling pressure.

If Bitcoin breaches this level, it could trigger short liquidations, fueling upward momentum.

Source: Hyblock

On the support side, Bitcoin found strength around the pdOpen + pdEQ zone, providing a potential entry point for bullish traders. Long liquidation levels below the pdLow indicated additional support layers that could prevent a sharp decline, especially if buying interest increases.

This consolidation reflected a market in wait-and-see mode. It aligns with broader trends in Bitcoin’s rising realized cap. This highlights strong long-term holder confidence.

What to expect in the coming months?

Historically, substantial price gains have often followed a rising realized cap during a BTC uptrend. This is because investor sentiment remains strong, and sell-offs are limited.

Bitcoin could be positioned for another rally if this trend continues, potentially reaching or even exceeding recent highs. Additionally, the Average True Range (ATR) values indicate manageable volatility, providing a stable environment for BTC’s continued growth.

– Read Bitcoin (BTC) Price Prediction 2024-25

The rising realized cap suggests a strong foundation for Bitcoin’s price, as long-term holders show minimal intent to sell.

If historical patterns hold, this trend could act as a launching pad for Bitcoin to achieve new price milestones.