After the martial law crisis, the National Assembly, which had been preparing to vote on various crypto-related bills, has reportedly deferred all discussions related to virtual asset regulation until at least the first half of 2025. An unnamed National Assembly official cited by the Chosun newspaper said that measures meant to clarify policies on initial coin offerings (ICOs), real-name accounts for cryptocurrency trading, permission for local companies to hold digital assets on their balance sheets, Bitcoin spot exchange-traded funds (ETFs), and securities token offerings (STOs) have all been effectively “buried” due to the impeachment crisis.

“Since martial law has taken all the attention of the National Assembly, it is difficult to say but we should deal with this first, even though there are many bills related to virtual assets,” the official told Chosun. The source said the public should anticipate “an indefinite postponement” until the political situation stabilizes. Prior to the turmoil, lawmakers had been expected to take significant steps to clarify crypto rules and potentially align South Korea with jurisdictions like the United States and Hong Kong, which are accelerating their own frameworks.

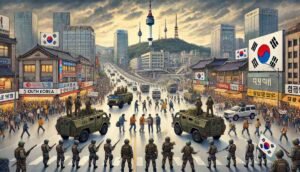

Martial law was unexpectedly declared by President Yoon during a televised address on December 3, a move that sparked immediate political and economic uncertainty. He accused the opposition of sympathizing with North Korea and placed the country’s legislative activities, protests, and media under military oversight. Though the National Assembly later nullified the order, and it was retracted within hours, the lingering fallout has forced lawmakers to focus their attention on impeachment measures and the upcoming budget, leaving the crypto agenda in limbo.

One of the few crypto-related measures that narrowly escaped this legislative freeze was the postponement of a planned tax on cryptocurrency profits. On December 10, just ahead of the political upheaval, the National Assembly voted to delay the imposition of a 22% tax on gains above 2.5 million won (approximately $1,750) until 2027. Had this measure not passed by December 10, the tax would have taken effect on January 1, 2025.

The upheaval has also rattled local cryptocurrency markets. On December 3, Bitcoin (BTC) prices plunged on Upbit, South Korea’s largest crypto exchange. Within 30 minutes of Yoon’s martial law announcement, Bitcoin reportedly fell by as much as 30%, dropping from 88,266,000 won ($61,600) to as low as 61,600 U.S. dollars before recovering. The volatility added to industry concerns that ongoing political instability might erode investor confidence and drive traders to friendlier markets overseas.

In response to the crisis, the Financial Services Commission (FSC), South Korea’s top financial regulator, opted to postpone rolling out finalized guidelines for corporate crypto accounts. Although the FSC had been preparing to implement these rules within the month, officials said the focus has now shifted back to traditional financial sectors—stocks, bonds, short-term funds, and foreign currencies—as they wait for a more stable political environment.

Market participants have long criticized South Korea’s patchwork of crypto rules for leaving both individuals and corporations without clear guidance and protections. With the latest delay, observers warn that the country risks falling behind global peers at a time when major jurisdictions are pushing forward with robust digital asset regulations.

Industry insiders and policy experts note that the indefinite postponement of these critical crypto reforms could prompt domestic blockchain firms to seek more accommodating regulatory climates abroad. Without a timely resumption of debate, they say, South Korea’s ambitions to become a competitive hub for digital finance and innovation remain in doubt.