Crypto liquidations hit nearly $300 million in just 24 hours, driven by Bitcoin’s sudden price surge.

Short positions faced the biggest losses, with over $206 million liquidated as Bitcoin broke key resistance levels.

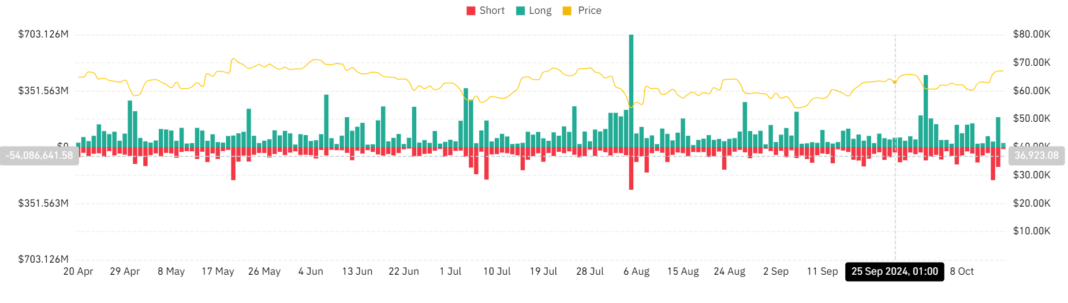

In the past few days, both long and short positions have experienced significant liquidations, with crypto liquidations reaching nearly $300 million in just 24 hours.

The catalyst for this surge in liquidations was a sudden price jump in Bitcoin [BTC], which broke through a key resistance level, causing a wave of forced liquidations across the market.

Crypto liquidations near $300 million

Data from Coinglass revealed that crypto liquidations climbed to almost $240 million on the 14th of October.

Short positions were hit the hardest, with approximately $206 million in liquidations, while long positions accounted for about $35 million.

However, the situation shifted in the following trading session. The next day, long position liquidations surged to over $187 million. Short positions continued to feel the pressure, facing over $123 million in liquidations.

This combined total represented the second-largest liquidation event of the month, trailing only behind the massive $500 million liquidation that occurred on the 1st of October.

Source: Coinglass

As of this writing, long positions continue to suffer, with more than $25 million in liquidations already recorded in the current trading session.

Bitcoin liquidations show strong consistency

The rapid price movement in Bitcoin triggered the recent wave of crypto liquidations. After a prolonged period of minimal price action, Bitcoin surged, leading to a series of liquidations, especially for short positions.

AMBCrypto’s analysis of the liquidation chart showed that on the 14th of October, Bitcoin liquidations totaled over $94 million. Short positions bore the brunt, accounting for $89 million.

In the following session, short liquidations dropped to almost $50 million, while long liquidations climbed to $27 million.

Source: Coinglass

This pattern suggests that Bitcoin’s recent price surge has disproportionately affected short traders as it continues to build momentum.

Bitcoin price trends

Looking at the Bitcoin’s price chart, on the 14th of October, the price surged by more than 5%. This caused a major impact on short positions, which saw over $200 million in liquidations.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The following day, Bitcoin continued its upward momentum, posting a 1% increase. This time, long positions took the majority of the hits in the liquidation market.

At press time, Bitcoin was trading in the $67,000 price range, showing a slight increase and further adding to the complexity of the crypto liquidations trend.