Crypto investment products netted $2.2 billion in inflows last week.

Bitcoin dominated the inflows amid increased chances of Trump winning the U.S. elections.

Last week, crypto market investors were heavily in risk-on mode, as noted by a whopping $2.2 billion inflows.

According to CoinShares data, this was the largest surge since July, underscoring a renewed bullish sentiment witnessed in the past few days.

Trump’s impact on BTC

Bitcoin [BTC] dominated nearly 99% of the weekly inflows, raking in $2.13 billion, making it the highlight of investors’ interest.

The impact of the massive inflows was also evident on the price charts, as the world’s largest digital asset rallied nearly 10%, rising from $62.4K to over $69K.

Source: CoinShares

According to CoinShares’ James Butterfill, the renewed market optimism was linked to increasing odds of Donald Trump winning the US presidential elections. He said,

“We believe this renewed optimism stems from growing expectations of a Republican victory in the upcoming US elections, as they are generally viewed as more supportive of digital assets. This, in turn, has led to positive price momentum.”

For context, last week, Trump’s odds of winning on the prediction site Polymarket topped 60% for the first time since July.

It stood at 64% at press time, a 28-point lead against Kamala Harris’s 34%.

Source: Polymarket

According to Presto Research’s analyst Min Jung, the momentum could continue in the coming weeks under two conditions.

“If Trump’s dominance continues and the Fed signals a more dovish stance, we could see renewed momentum for Bitcoin in the weeks following these events.”

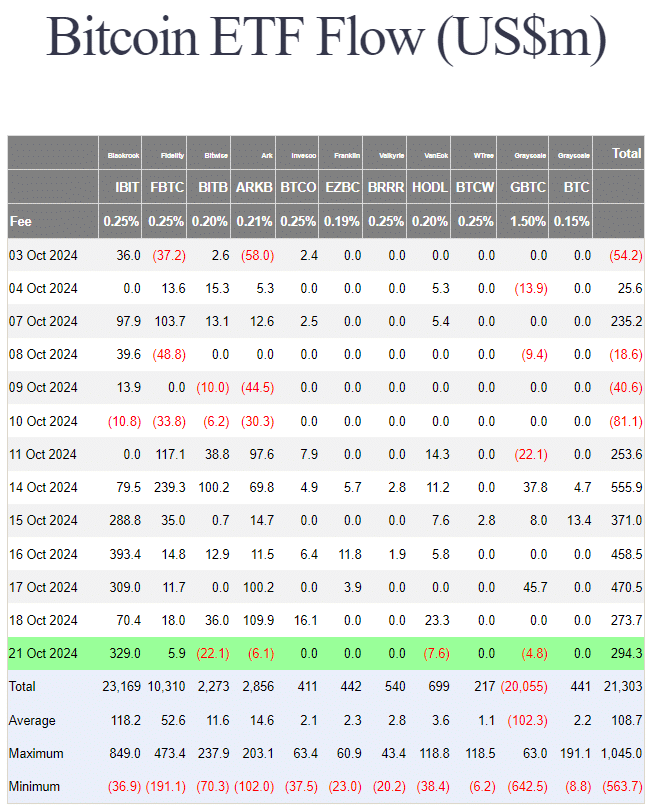

That said, strong demand from US spot BTC ETFs also pushed the products to a new high in net assets held. It crossed $66.1 billion in total net assets under management (AUM).

Source: Soso Value

Other altcoins also showed renewed traction, with Ethereum [ETH] logging $57.5 million and Solana [SOL] tapping $2.4 million.

With only about two weeks to the US elections, will the bullish streak in the crypto markets continue?

Well, crypto trading firm QCP Capital was confident that the uptrend could extend, citing options data. It stated,

“Markets are bracing for a volatile #Election: While #BTC skews towards bullish calls despite trading 8% below its peak, the S&P 500 hedges with put protection ahead of a potential 1.8% post-election swing.”

It meant that crypto investors were optimistic about upside potential (buying call options) while the US stock market feared pullback (buying put options).