Buying pressure on Bitcoin increased over the last week.

BTC successfully tested a support and might soon move towards $68k.

Bitcoin [BTC] has once again entered the consolidation phase as its price lingered around $67k. Meanwhile, the big-pocketed players in the game chose to cash in profit. Will this have a negative impact on BTC’s price in the coming days?

Bitcoin whales create buzz

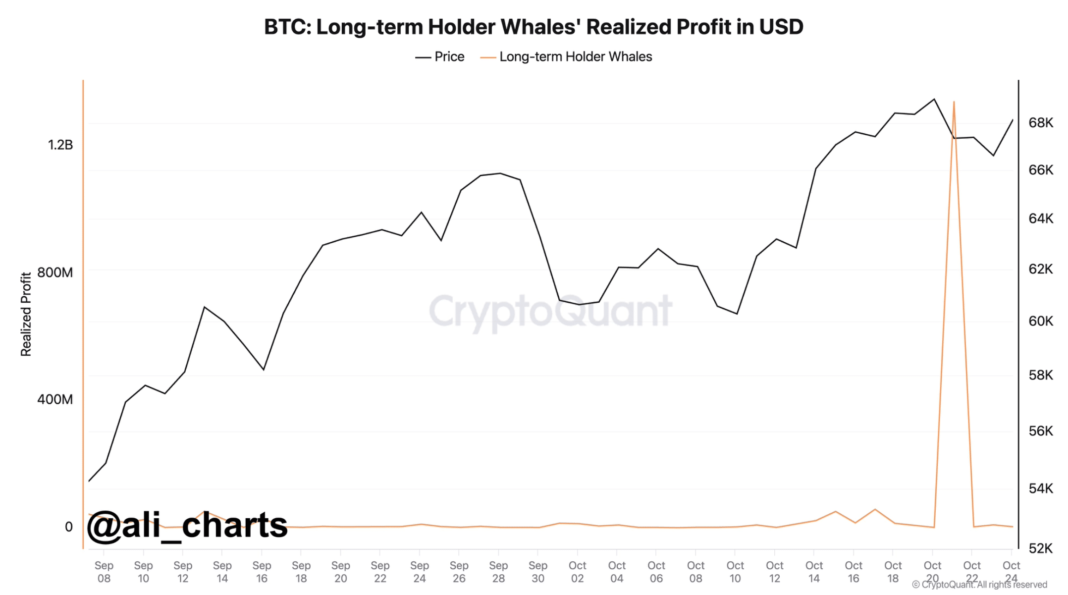

Ali, a popular crypto analyst, recently posted a tweet highlighting an interesting development. As per the tweet, Bitcoin whales recently cashed in over $1.4 billion in profits. This was evident from the massive rise in BTC’s long-term holders whales’ realized profit in USD.

Source X

In fact, AMBCrypto also reported earlier the rise in BTC whale activity. BTC whales’ have increased as they expand their holdings towards the 4 million mark. With this, BTC whales reached the 2021 levels.

AMBCrypto then planned to check market sentiment to find out whether the surge in whale activity had any impact on buying behavior. As per our analysis of Santiment’s data, BTC’s exchange outflow spiked on the 20th of October 2024.

Thanks to that, BTC’s supply on exchanges dropped while its supply outside of exchanges increased. All of these metrics indicated that buying pressure on the king coin was high. A hike in the metric is considered a bullish signal as it is often followed by price hikes.

Source: Santiment

Will BTC finally turn volatile again?

While all this happened, BTC’s price started to consolidate. The king coin’s price moved only marginally over the last week. At press time, it was trading just above $67k.

To better understand whether the rise in buying pressure will allow BTC to register gains, AMBCrypto checked CryptoQuant’s data.

According to our analysis, BTC’s aSORP turned red. This indicated that more investors have recently started selling at a profit. In the middle of a bull market, it can indicate a market top.

Another bearish metric was the NULP. The metric revealed that investors were in a belief phase where they are currently in a state of high unrealized profits.

Source: CryptoQuant

Apart from this, Bitcoin’s long/short ratio also witnessed a major decline. A drop in the metric means that there are more short positions in the market than long positions.

Whenever that happens, it indicates that bearish sentiment around an asset is increasing.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

We then took a look at the king coin’s daily chart. The Bollinger Bands revealed that BTC has successfully tested its support at the 20-day SMA.

Moreover, the technical indicator also suggested that BTC’s price was in a high volatility zone. These indicated that in case of an upward price move, BTC might soon reach its resistance at $68.5k.

Source: TradingView