Bitcoin cooled off after its latest rally, but Futures demand soared to levels last seen over a year ago

Market is now embracing caution amid growing levels of uncertainty over major event

Bitcoin’s latest rally raised hopes of the crypto’s price potentially soaring to new highs. However, despite a brief hike to $73k, the crypto has since dipped below $70,000. While this indicated that profit-taking has been going on, recent observations suggest there may be uncertainty in November.

Will Bitcoin bulls regain control or is this the start of a major pullback? Well, according to a recent CryptoQuant analysis, Bitcoin has been recording robust buying pressure from Bitcoin Futures whales.

According to the same, the last time the Futures demand was so high was in September 2023. Following this event, Bitcoin embarked on a solid bullish run until April. Will things turn out similar this time?

The hike in Bitcoin Futures may be in line with bullish expectations or sentiment among Futures investors. However, BTC demand slowed considerably over the last few days. For example, there seemed to be a surge in Bitcoin Spot ETF inflows over the last 7 days.

However, the last day of October was characterized by the lowest inflows during the week.

Bitcoin traders embrace a cautious approach

The sudden decline from institutional buyers (ETFs) signaled a sudden shift towards the side of caution. This was a reflection of the recent price shift and demand dynamics.

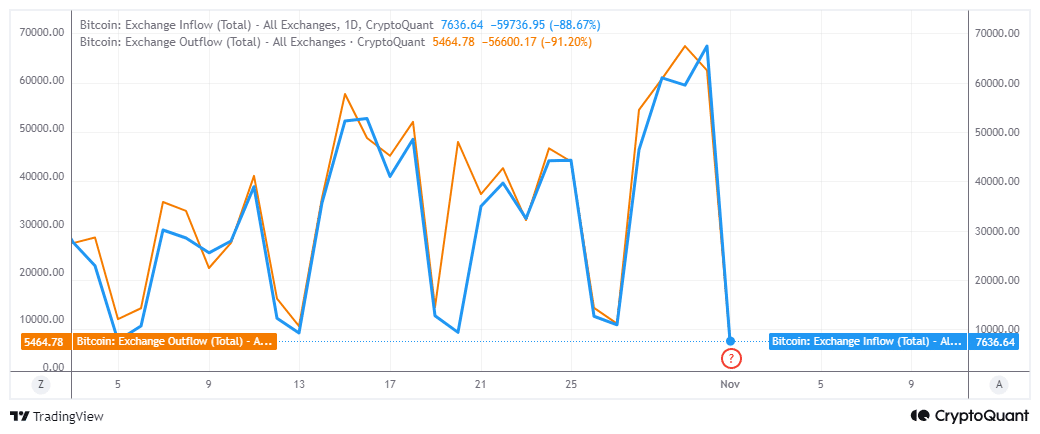

Bitcoin exchange flows peaked at 67,373 BTC on 31 October, notably higher than outflows which peaked at 62,024 BTC on the same day.

Source: CryptoQuant

Bitcoin exchange flows have since dropped to their lower range, with inflows still notably higher than outflows. This confirmed that sell pressure has since outweighed demand, hence the price dip.

The market also demonstrated a decline in the appetite for leverage over the last 2 days. This suggested that investors have been unsure about the extent of the latest retracement. This, because the latest wave of bullish optimism has many expecting higher prices in the coming weeks.

Source: CryptoQuant

Bitcoin’s Open Interest also dipped significantly, confirming that derivatives traders are also exercising caution. Both the Estimated leverage ratio and the Open Interest metrics previously soared to their highest 2024 levels towards the end of October.

One reason why people are cautious is because they expect the U.S elections to yield some volatility. This also means that Bitcoin could resume normal supply and demand activity after the elections are done.

The outcome may also influence the level of demand. This, combined with the surge in Futures, may lead to extremely volatile movements.