Market analysts and options traders are increasingly bullish, with many predicting a potential surge to $80,000 and beyond, regardless of who wins the White House.

Bitcoin’s recent price action has been nothing short of impressive. Fueled by inflows into Bitcoin ETFs and speculation surrounding the election outcome, the largest cryptocurrency has seen a 66% increase in 2024. This resilience, despite scaled-back expectations for Federal Reserve rate cuts and increased scrutiny of stablecoin Tether, has boosted confidence in the market.

Source: Brave New Coin Bitcoin Liquid Index

Analysts Forecast Election-Driven Rally:

Tony Sycamore, a market analyst at IG Australia Pty, notes that Bitcoin is reflecting the anticipation surrounding the US election. He believes a sustained break above $70,000 could pave the way for a new all-time high, surpassing March’s record of $73,798.

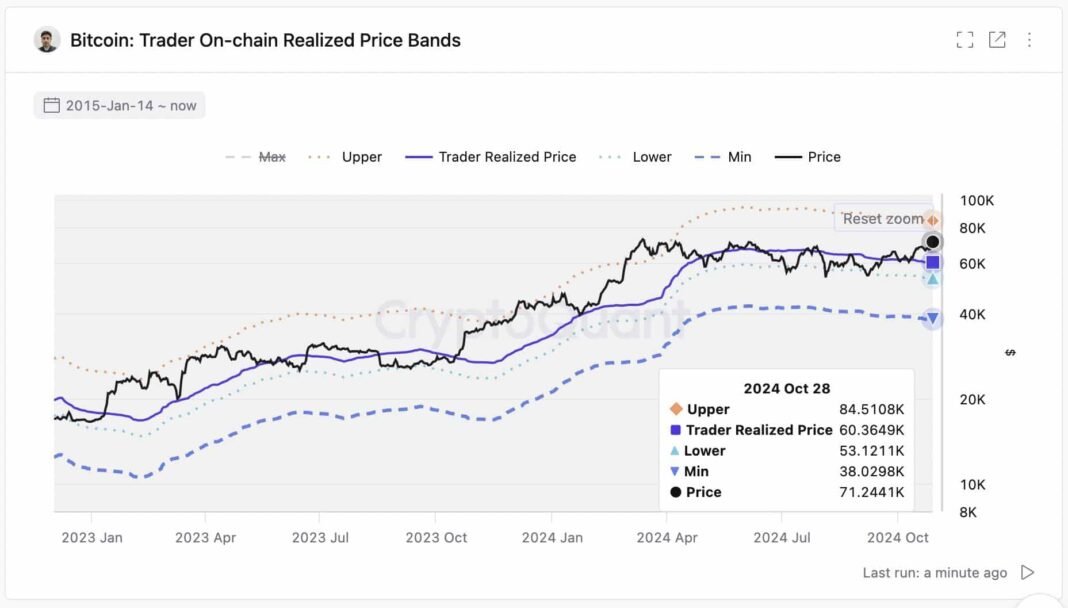

Standard Chartered’s Geoffrey Kendrick echoes this sentiment, predicting Bitcoin will reach $73,000 by election day, something Bitcoin has already achieved, and surge past $80,000 shortly after. Their analysis, based on options data and betting odds, suggests a strong correlation between the election outcome and Bitcoin’s price trajectory.

Options Traders Bet Big on $80,000 Target:

Options traders are also betting big on a Bitcoin breakout, with increased activity focused on call options at the $80,000 strike price for November and December expiry dates.

David Lawant, head of research at FalconX, observes a “notable topside-heavy bias” in options activity surrounding the election. This indicates a growing belief that Bitcoin will perform well regardless of the political outcome.

Yev Feldman, co-founder of SwapGlobal, points to the decreasing put-to-call ratio as further evidence of bullish sentiment. He believes a post-election surge is more likely than a collapse, given the limited downside potential.

Beyond the Election: Factors Fueling Bitcoin’s Momentum:

Beyond the immediate impact of the election, several factors are contributing to Bitcoin’s positive momentum. Bitcoin has historically exhibited strong performance in the fourth quarter, particularly in years following a halving event. This seasonal trend, combined with the growing institutional interest in Bitcoin, creates a favorable environment for further price appreciation.

Furthermore, Bitcoin’s ability to rebound from a September dip and maintain a 30% gain demonstrates its underlying strength and resilience in the face of market volatility. This resilience, coupled with increasing mainstream recognition and adoption, suggests that Bitcoin’s long-term outlook remains optimistic.

With a combination of bullish factors, including positive election speculation, strong seasonal trends, and growing institutional adoption, Bitcoin appears poised for a potential surge towards $80,000 and beyond.