Binance, the world’s largest cryptocurrency exchange, has teamed up with Circle, the company behind the USDC stablecoin, to drive global adoption of digital dollars.

Announced at Abu Dhabi Finance Week, this strategic partnership aims to make USDC more accessible for Binance’s 240 million users worldwide, enabling them to use it for trading, saving, and payments.

As per the announcement, Binance will adopt USDC as a stablecoin for its corporate treasury, signaling a move toward increased reliance on blockchain-based financial tools. This partnership also means Binance will roll out more USDC trading pairs, offer special promotions, and integrate the stablecoin across its platform to enhance its utility.

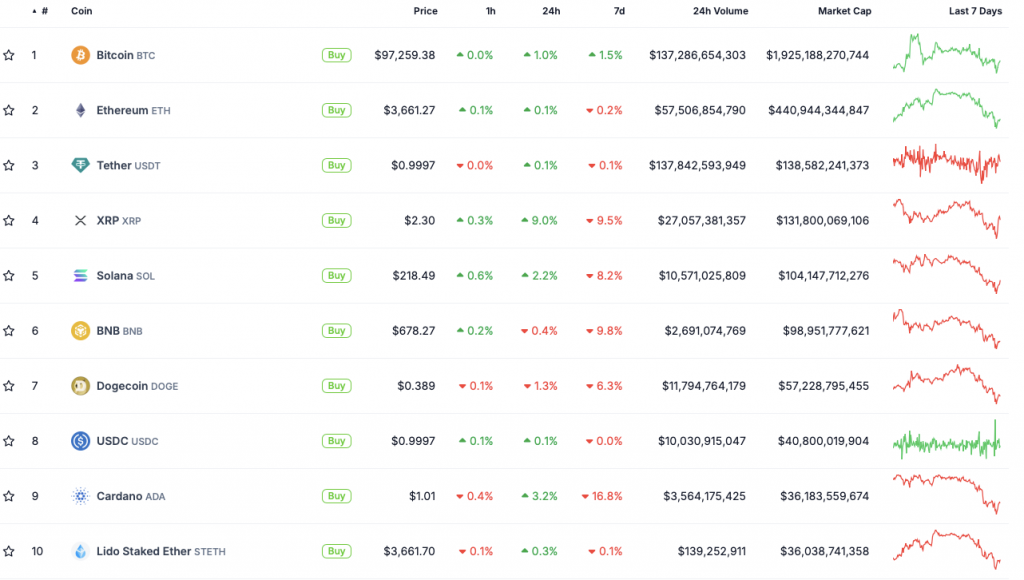

Circle, which oversees $40 billion worth of USDC in circulation, will support Binance with the necessary technology, liquidity, and expertise. The partnership also opens opportunities to build connections in global finance and commerce, as companies explore the benefits of stablecoins for remittances, inflation hedging, and seamless cross-border payments.

While speaking on the partnership, Binance CEO Richard Teng said, “This partnership creates exciting opportunities for our users to leverage USDC. Together with Circle, we aim to drive innovation and utility for stablecoins worldwide.”

The tie-up also underscores Binance’s effort to align with global regulations after settling U.S. allegations last year with a $4 billion payment. USDC, often marketed as a more regulated alternative to Tether’s USDT, has found a strategic ally in Binance as both companies push the boundaries of crypto adoption.

Circle’s CEO Jeremy Allaire highlighted the significance of the partnership, stating, “With Binance becoming the leading financial super app, this is a tremendous opportunity for USDC to grow as a trusted and compliant digital dollar.”

In a separate development, Circle also announced a partnership in Abu Dhabi with LuLu Financial Holdings to enhance remittance and cross-border payment solutions using USDC. Meanwhile, Tether continues to strengthen its presence in the region, securing regulatory acceptance for USDT in Abu Dhabi’s financial hub.

Also Read: io.net Partners With Mira Network to Advance AI Verification