The proposal, put forward by Anton Tkachev, a deputy from the New People party in the State Duma, urges Finance Minister Anton Siluanov to integrate Bitcoin into Russia’s state reserves. Advocates say doing so would lessen the country’s reliance on traditional foreign currency reserves, which remain vulnerable to inflation, market swings, and punitive measures imposed by the United States and its allies.

Source: X

Bolstering Resilience Through Digital Assets

Tkachev’s appeal follows a series of legal and policy initiatives in Russia aimed at embracing digital assets. Since the outbreak of the Ukraine crisis, Moscow has faced waves of Western sanctions that have curbed access to global financial systems. In response, President Vladimir Putin’s administration has taken steps to legitimize cryptocurrencies—particularly Bitcoin—as a means of bypassing restrictions.

“Who can ban Bitcoin? Nobody,” Putin was quoted as saying this month, according to local media. His stance signals an increasingly clear vision for digital currencies as both economic shield and technological inevitability. In recent months, Russia legalized Bitcoin mining, recognized digital currencies as property for foreign trade, and allowed the central bank to pilot cross-border crypto transactions, building a framework to operate outside conventional financial channels.

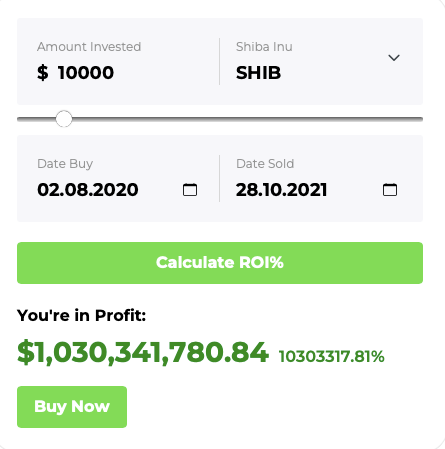

Tkachev cited Bitcoin’s recent price surge to around $100,000—up from historic highs earlier this month—as evidence of its staying power and potential role as a stable store of value. By incorporating Bitcoin into state reserves, he argued, Russia could mitigate sanctions-related shocks, spur investment, and secure a foothold in a financial landscape less dependent on the U.S. dollar.

A Global Trend Gains Traction

Russia’s exploration of Bitcoin as a reserve asset aligns with a broader global shift. In recent years, several countries, large and small, have turned to cryptocurrencies to bolster their financial defenses. El Salvador pioneered the approach by making Bitcoin legal tender. Brazil and Poland have taken steps toward integrating digital currencies into their financial strategies, citing reduced costs and enhanced financial independence.

In the United States, President-elect Donald Trump has pledged to establish a substantial Bitcoin reserve. His proposal, still in its early stages, has gained attention from U.S. lawmakers who see cryptocurrencies as a hedge against the dollar’s waning global influence.

Analysts say these developments indicate an evolving geopolitical landscape in which cryptocurrencies serve as counterweights to sanctions and central-bank-driven currency volatility. While digital assets once seemed the domain of retail investors and private companies, they are now increasingly seen as strategic tools that governments may deploy to navigate a complex global economy.

Legal Foundations and Economic Rationale

Russian policymakers have moved swiftly to provide the necessary regulatory scaffolding. Earlier this year, Putin signed legislation exempting crypto mining from value-added tax (VAT) and introduced a clear tax regime for digital assets, allowing the government to monetize this new financial frontier while encouraging compliance and stability.

Individuals earning less than 2.4 million rubles ($22,300) in cryptocurrency profits now face a 13% tax, while those above that threshold pay 15%. Corporations, for their part, will be taxed at 25% starting next year. The measures aim to foster a controlled environment for crypto transactions, balancing the need for oversight with the desire to encourage innovation and foreign investment.

This combination of legislative support and presidential endorsement sets the stage for Russia to position itself at the vanguard of state-driven crypto adoption. By integrating Bitcoin into its national reserves, the Kremlin hopes to secure a more autonomous financial apparatus, one less vulnerable to dollar hegemony and the reach of Western sanctions.

Implications for the Future

While Russia has not yet officially responded to Tkachev’s proposal, the mere suggestion highlights how swiftly digital assets are gaining traction as instruments of statecraft. Should the plan advance, it could pave the way for other sanctioned countries to adopt similar measures, potentially diminishing the impact of geopolitical tensions on global financial flows.

Such a shift would also bolster the legitimacy and value of cryptocurrencies, lending them greater stability and appeal in international markets. Proponents say that by breaking free from the constraints of traditional payment systems, nations like Russia stand to gain economic autonomy and strategic leverage.

Yet significant challenges remain. Widespread adoption of Bitcoin and other cryptocurrencies as reserve assets would require robust cybersecurity, international cooperation, and thorough regulatory frameworks—areas that remain underdeveloped in much of the world.

For now, though, Russia’s move signals that digital currencies may be entering a new phase as instruments of national policy. As more countries consider following suit, the global financial order could witness a profound realignment—one that places Bitcoin and its crypto counterparts at the heart of economic strategy.