Revenue Secretary Sanjay Malhotra’s recent saying on tax may have caught the attention of India’s cryptocurrency community, but has left them with mixed feelings.

Crypto investors in India have been struggling under high taxes that make trading and investing a costly affair.

A 30% tax levied on profits, no way to offset losses, and a 1% TDS (tax deducted at source) on every crypto transaction have made it tough for crypto traders and businesses to thrive. Many feel these rules are stifling innovation while driving talent and investment out of India.

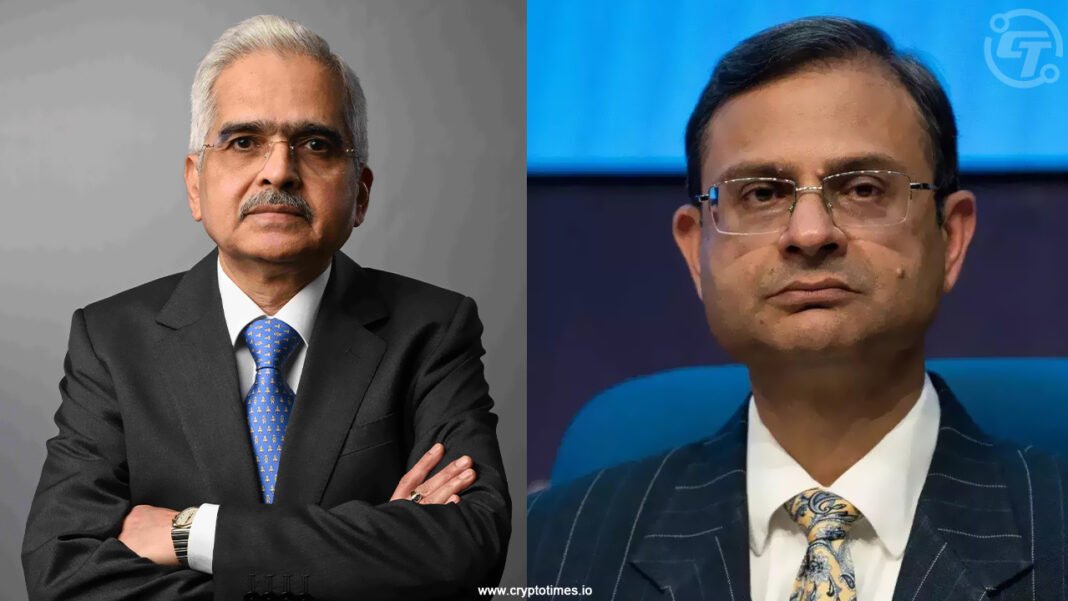

Sanjay Malhotra recently advised tax officials to ensure that tax collection does not negatively impact industries or the economy. He cautioned against the dangers of overly aggressive taxation, stressing that these warnings should not be ignored.

For the crypto industry, this statement brings a glimmer of hope. Could it mean the government is open to rethinking its harsh tax policies on crypto? Will crypto investors see a reduction in the 30% tax rate, a 1% TDS, or even the introduction of loss-offsetting rules?

Earlier this year, RBI Governor Shaktikanta Das has been very critical of cryptocurrencies, calling them “highly speculative” and saying India needs to be very cautious. He warned that cryptocurrencies could cause big problems for countries like India, including risks to financial stability, currency value, and the overall money system.

Many are hoping that Malhotra’s words could mean some relief, but whether these concerns will turn into real action or not, is still uncertain. As the government and regulators figure out their next steps, the future of India’s crypto industry remains unpredictable.

Also Read: India’s Crypto Policy is Submissive, Claims Congress Minister