FLOKI has entered the Coinbase roadmap, becoming the third memecoin to do so in the last three days

However, despite the initial momentum, a parabolic run still remains elusive

Floki [FLOKI] just got a major boost with its listing on Coinbase, capturing the attention of investors. Coincidence or not, this listing came on the back of the market’s recovery, giving FLOKI a strong shot at a parabolic run.

While the 70% weekly gains could mean momentum for the altcoin, some may say the market’s getting overheated. However, this bull cycle feels different, especially with Bitcoin entering a high-risk zone.

Typically, at this stage, investors are likely to seek low-risk, high-cap assets to redistribute profits from the post-election bull cycle. Especially since BTC has already been pushed to a new ATH of $93k.

As a result, it may still be too early to say if FLOKI is gearing up for a correction. If anything, with its Coinbase listing and investors seeking safer bets, FLOKI could be primed for a big move ahead.

Whales accumulate FLOKI, but there’s a catch

Over the past two cycles, the market has undergone a significant shift, making memecoins less susceptible to sudden swings as more investors recognize them as a growing asset class with real use cases.

Until the last cycle, DOGE reaped the most benefits. However, this cycle has brought a shift even within the memecoin community. Over the last three days, Coinbase has listed three top memecoins – PEPE, WIF, and FLOKI – on its roadmap.

The massive surge that followed, with each coin posting a daily high of over 20%, truly showcased their vast hold on the market, even pushing top altcoins behind.

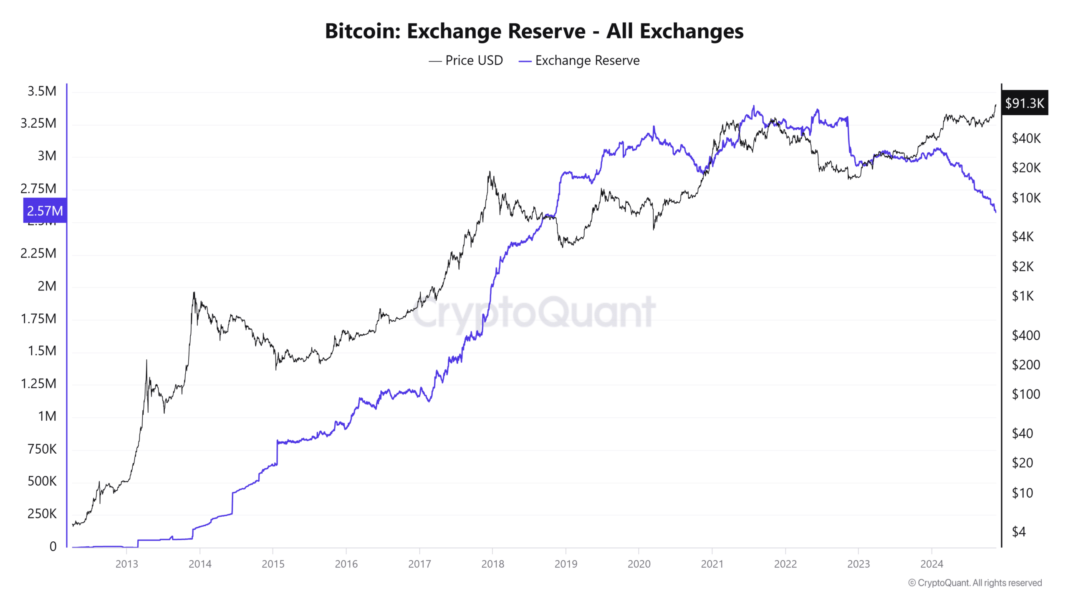

In the future, this shift will likely steer major memecoins, including FLOKI, to capture notable capital flows away from Bitcoin during periods of high volatility.

As a result, addresses holding 1 billion FLOKI tokens have responded bullishly to the listing, now holding 55 billion in total. This marked a staggering increase from 52 billion in just over a day.

Source : Santiment

While this seems bullish on the surface, there may be another factor at play. Looking at the chart above, the inconsistency in whale accumulation cannot be overlooked, highlighting the high volatility inherent in memecoins.

Therefore, unless Bitcoin breaks a key psychological level, predicting whether FLOKI can maintain its upward trajectory will be challenging.

The reasoning is simple – Bitcoin, valued at $91k (at the time of writing), has faced significant resistance around the $90k-mark, which historically triggered massive rallies in memecoins.

Now, with the hype from the Coinbase listing fading, FLOKI’s price could reverse given that the RSI seemed to be in overbought territory. Weak hands may shake out after locking in gains, with whale accumulation remaining inconsistent too.

Therefore, for a potential parabolic move towards $0.00030, Bitcoin will likely need to break through the $93k resistance level. Doing so might help sustain investor confidence in FLOKI’s long-term prospects.

Odds of Bitcoin breaking key psychological level

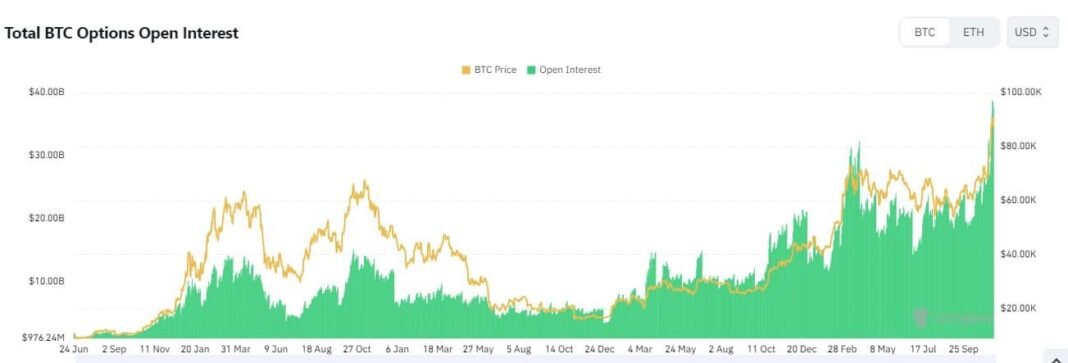

Looking at the daily price chart, Bitcoin surged to an all-time high in under 10 trading days, a move sparked by a massive rush following the election results.

However, momentum has since stalled, with Bitcoin consolidating within the $90k – $91k range over the last three days. These rapid gains in such a short period have set this cycle apart from others.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

Unlike previous election cycles, when BTC never retraced below its election-day price level, this time it has pulled back.

This means that despite routine endorsements from the newly elected president, Trump, the fundamental human element of ‘exercising caution,’ remains unchanged. This makes this cycle more volatile than previous ones.

In summary, unless Bitcoin hits a price level seen as the right, affordable ‘dip’ for new entrants, bulls will struggle to break the resistance at $93k. Therefore, until these issues resolve themselves, memecoins like FLOKI will likely remain consolidated or face a potential correction.