Bitwise CIO believes that Bitcoin is still in its infancy.

The king coin continued to ride the post-election bullish momentum.

Not even halfway through Moonvember, and Bitcoin [BTC] continues to shatter its own records. The latest one comes as BTC smashed past the $90,000 mark to peak at a new ATH of over $93,000.

However, the price dipped shortly after. At press time, the largest cryptocurrency traded at $89,604, representing a downtick of 0.98% over the past day. Nonetheless, the yearly gains stood strong at $152%.

While this meteoric rise has led to massive gains for HODLers, it has also sparked concerns among potential investors, who fear it may be too late to enter the market. But is that truly the case?

Bitwise CIO’s vision for Bitcoin

In his latest memo, Matt Hougan, Chief Investment Officer of Bitwise, reassured those who feel they’ve missed the chance to invest in Bitcoin.

Hougan emphasized that, in his view, Bitcoin will be considered “early” until it reaches a price of $500,000. He stated,

“$500K per coin is the correct demarcation.”

Despite the volatility and unpredictable nature of the asset, the exec sees this price as a threshold that separates being early from being late in the Bitcoin market, explaining,

“It marks the point where bitcoin would be mature.”

Bitcoin vs gold

The CIO elaborated that Bitcoin hasn’t yet reached the level of maturity seen with gold. Despite recent growth, skepticism towards the king coin from regulatory bodies and media remains quite evident.

While the market has made notable strides, fueled by the success of Bitcoin exchange-traded products [ETPs] and increasing backing from pro-crypto policymakers, he remarked,

“But until bitcoin is as boring as gold—widely held by central banks and institutions alike—it’s by definition still early.”

But, what would it take for Bitcoin to get on the same level as gold? Hougan drew comparisons with gold’s $18 trillion market to Bitcoins approximately $2 trillion, comprising the total $20 trillion store of value market.

For BTC to make up half of that, it would need to be valued at $500,000 per coin, making it a truly established asset.

Mapping BTC’s path to $500K

Given the current price levels, reaching $500,000 would require an appreciation of close to 460%. Ergo, the question remains—How will BTC bridge this gap?

Hougan explained that one of the most important catalysts for this rise would be the involvement of the central banks.

He pointed out that while governments hold around 20% of the world’s gold reserves, they control less than 2% of the global Bitcoin supply.

Therefore, this wide divergence in investment would need to change. Worth noting that Donald Trump’s second presidential term could see these dreams turn into reality.

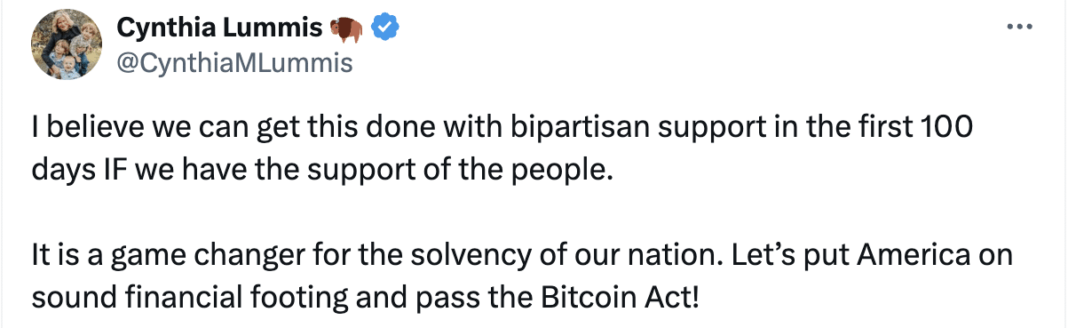

American Senator Cynthia Lummis has expressed optimism that plans to create a strategic Bitcoin reserve will be implemented soon after Trump’s inauguration. In the latest post on X, she noted,

Source: Cynthia Lummis/X

Previously, AMBCrypto reported that Barbara Goodstein, Managing Partner at R360 also foresees Bitcoin becoming the new strategic asset. If that happens, Hougan’s price target may finally materialize.