U.S. Bitcoin ETF holdings are rapidly approaching that of Satoshi Nakamoto’s.

With $3.4 billion inflow post-election, Bitcoin ETFs are also accumulating 17,000 BTC weekly

Bitcoin’s [BTC] recent move towards the $90,000 mark has fueled excitement across financial markets, significantly impacting the spot Bitcoin ETFs in the U.S.

These ETFs are on course to potentially eclipse the holdings of Bitcoin’s creator, Satoshi Nakamoto, by becoming the largest collective Bitcoin holders.

Bitcoin ETFs to surpass Satoshi Nakamoto’s holdings?

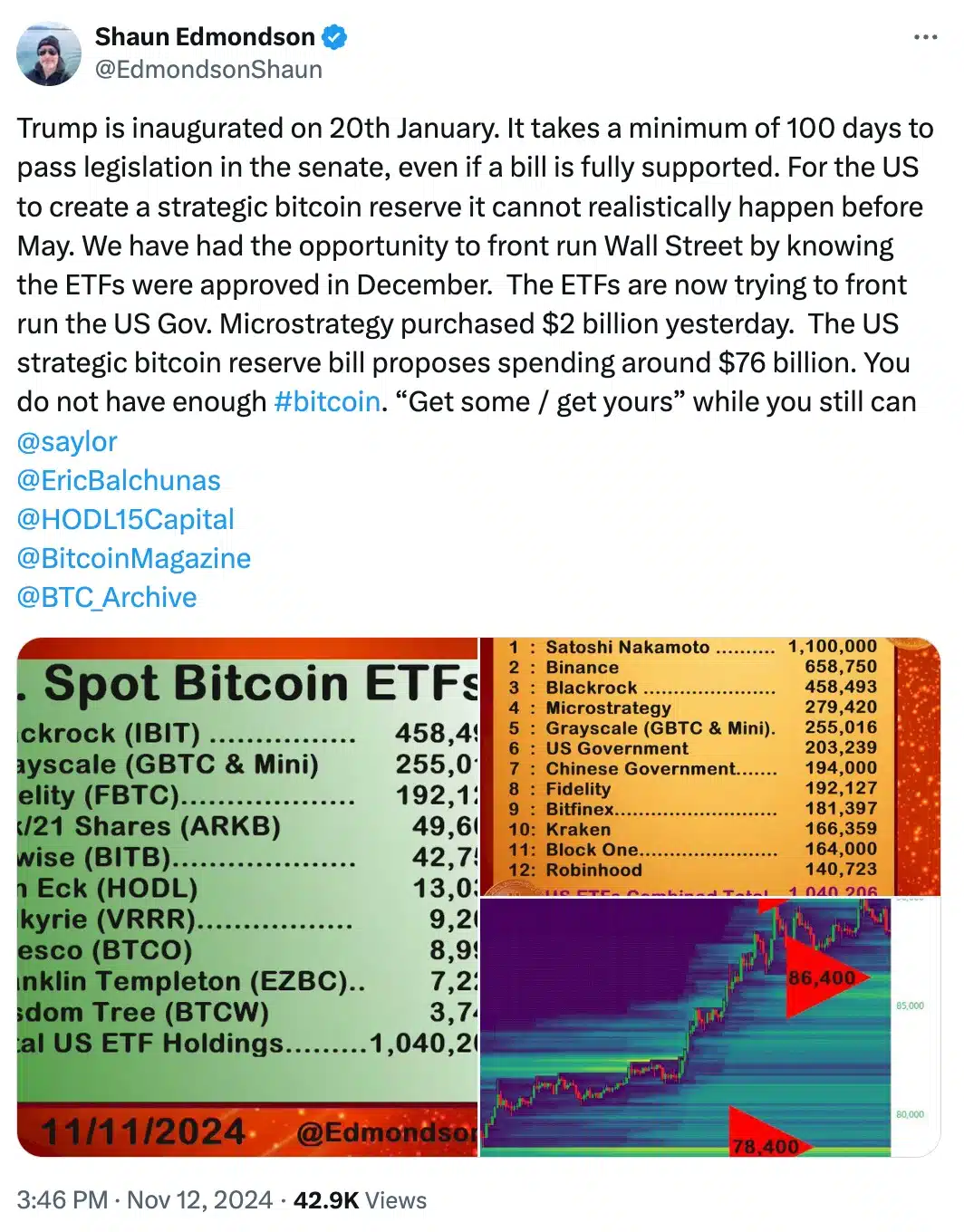

According to data from analyst Shaun Edmondson and Bloomberg’s Eric Balchunas, U.S. spot Bitcoin ETFs have amassed approximately 1.04 million BTC—just shy of Satoshi’s estimated 1.1 million BTC.

This accumulation reflects a growing institutional appetite for Bitcoin, as the asset continues to gain traction within mainstream investment portfolios.

Remarking on the same, Edmondson noted,

Source: Shaun Edmondson/X

Adding to which, Balchunas said in his prediction,

“ETFs now 95% of the way to passing Satoshi as largest holder. Countdown clock in effect. Thanksgiving feels like a good over/under date.”

Bitcoin ETF update

As of 28th October, U.S. Bitcoin funds reported a collective holding of 983,334 BTC, indicating a substantial accumulation of over 56,000 BTC within the past two weeks.

Addditioanlly, recent data from Farside Investors highlights the surge in interest, with U.S. spot Bitcoin ETFs attracting an impressive $3.4 billion in just four days following Election Day.

That being said, last Thursday marked a record performance for Bitcoin ETFs, as investors injected around $1.3 billion into these funds.

BlackRock’s IBIT alone saw a staggering $1.1 billion inflow, coupled with exceptionally high trading volumes.

According to the latest data from Farside Investors, U.S. Bitcoin ETFs on 12th November continued to see strong inflows, with a total of $817.5 million, while IBIT accounted for the largest share at $778.3 million.

What’s behind this?

Analyst Eric Balchunas noted that these funds are accumulating Bitcoin at a rapid pace of about 17,000 BTC per week, putting them on track to surpass Satoshi Nakamoto’s estimated holdings by December 2024.

In fact, some credit of this accelerated accumulation also goes to Donald Trump’s election win.

However, some believe the election isn’t the only factor at play. The fourth Bitcoin halving is also a significant influence, as highlighted by Jesse Myers, co-founder of OnrampBitcoin.