The SEC recently approved some BTC ETF Options.

Spot Bitcoin ETF saw an increased net flow in the past week.

Last week, the Securities and Exchange Commission (SEC) approved the listing and trading of several Bitcoin [BTC] ETF Options.

This marked a significant step forward in bridging traditional financial markets with the rapidly expanding digital asset space.

Major institutional players like Fidelity and Grayscale were taking the lea to establish ETF options as a crucial component of a diversified investment portfolio.

The approval signals regulatory clarity

On the 18th of October, the SEC approved the listing and trading of options for 11 spot Bitcoin ETFs, reinforcing the growing acceptance of Bitcoin ETF Options by financial regulators.

This regulatory endorsement is instrumental in fostering wider adoption.

As more ETFs gain approval for options trading, Wall Street’s interest in these financial products continues to rise.

Institutional traders now have a clearer regulatory framework for engaging with Bitcoin ETF Options, increasing their confidence in the market.

The approval indicates a broader shift toward recognizing Bitcoin ETF Options as legitimate financial instruments, with Wall Street increasingly viewing them as valuable tools for portfolio diversification.

This regulatory clarity and growing trust could signal a major step toward the acceptance of digital assets in mainstream finance.

Bitcoin ETFs experience net flow surge

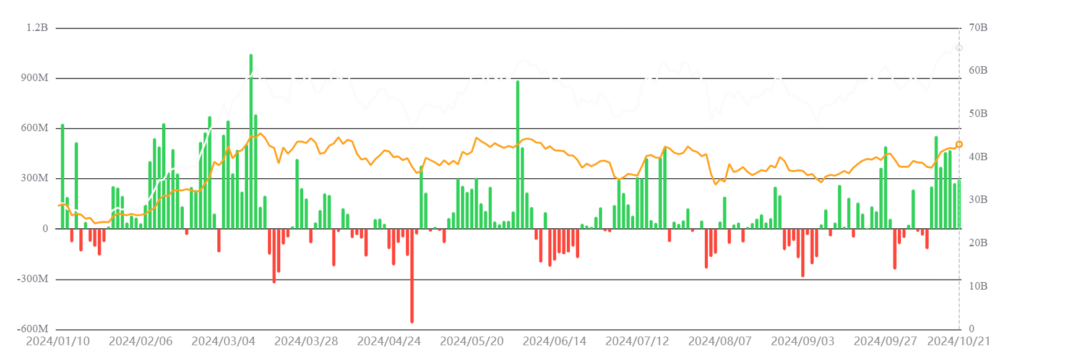

Recent data from SosoValue showed that Bitcoin ETFs have experienced positive inflows over the past week. The analysis revealed an inflow of approximately $2.7 billion, bringing the total net assets to over $65 billion.

These inflows highlighted the heightened interest from institutional investors, with capital flowing in and out of the market.

Source: SosoValue

With the introduction of Bitcoin ETF Options, liquidity is expected to rise. This will offer investors new ways to hedge their positions or speculate on future price movements.

This could lead to a more stable price action for both Bitcoin and its associated ETFs.

How Options could shape Wall Street portfolios

The rise of Bitcoin ETF Options presents a significant opportunity for traditional financial institutions and the broader crypto market.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Offering a regulated and flexible approach to Bitcoin exposure, these options open up new avenues for investors.

As regulatory frameworks continue to evolve and more financial institutions embrace Bitcoin ETF Options, these products are poised to play a central role in future investment strategies on Wall Street.